Questions and Answers

Clear answers to frequently asked questions about bonds: issuance, payment, repayment, transfers, and personal data protection.

Questions and Answers

Our strategy is to invest in real estate in the Czech Republic, either to increase its value through renovation and subsequent sale, or for the purpose of holding and renting the properties. We are also involved in the development of apartment buildings and family houses. Specific projects we are working on, including photo documentation, can be found HERE.

The bond subscription agreement can be signed either in person at our headquarters in the eFi Palace building, Bratislavská 234/52, Brno, or via correspondence. If you're interested in subscribing, you can also fill out the order form directly HERE. In that case, we will send you the subscription agreement by post to the address you provide. Once the agreement is signed, you have fifteen days to transfer the investment amount to the account specified in the contract. After the funds are received and the bond issue date has passed, your bonds will be prepared for delivery. You can either pick them up in person, or we can send them to your correspondence address. In that case, we send them as an insured valuable shipment with a declared value equal to the value of the bonds. If you request shipment of bonds worth over one million CZK, the delivery will be split into multiple insured parcels to comply with Czech Post's insurance limits.

The entire bond purchase can be arranged without a personal meeting; however, the contract must be signed in written form. Therefore, a first visit to the post office is usually necessary to send the letter with the contract, and a second visit to send the letter with the bond handover protocol.

We do not charge any fees for the purchase, holding, or repayment of the bonds. The only exception is when an investor requests an early redemption of the bond. In such a case, the principal amount and the proportional part of the interest of the redeemed bond are reduced by a percentage specified in the terms of the particular issue. For example, with the e-Finance Property 23 bonds, this reduction is 7%. In some exceptional cases, you may incur a small cost due to the need to have your signature verified on documents you send to us.

The interest from the bonds is paid for each issue on predetermined fixed dates by transfer to the investor's bank account registered with us. We deduct withholding tax from the interest at the statutory rate (currently 15%). On the bond’s maturity date, the principal is also repaid by bank transfer to the investor's account.

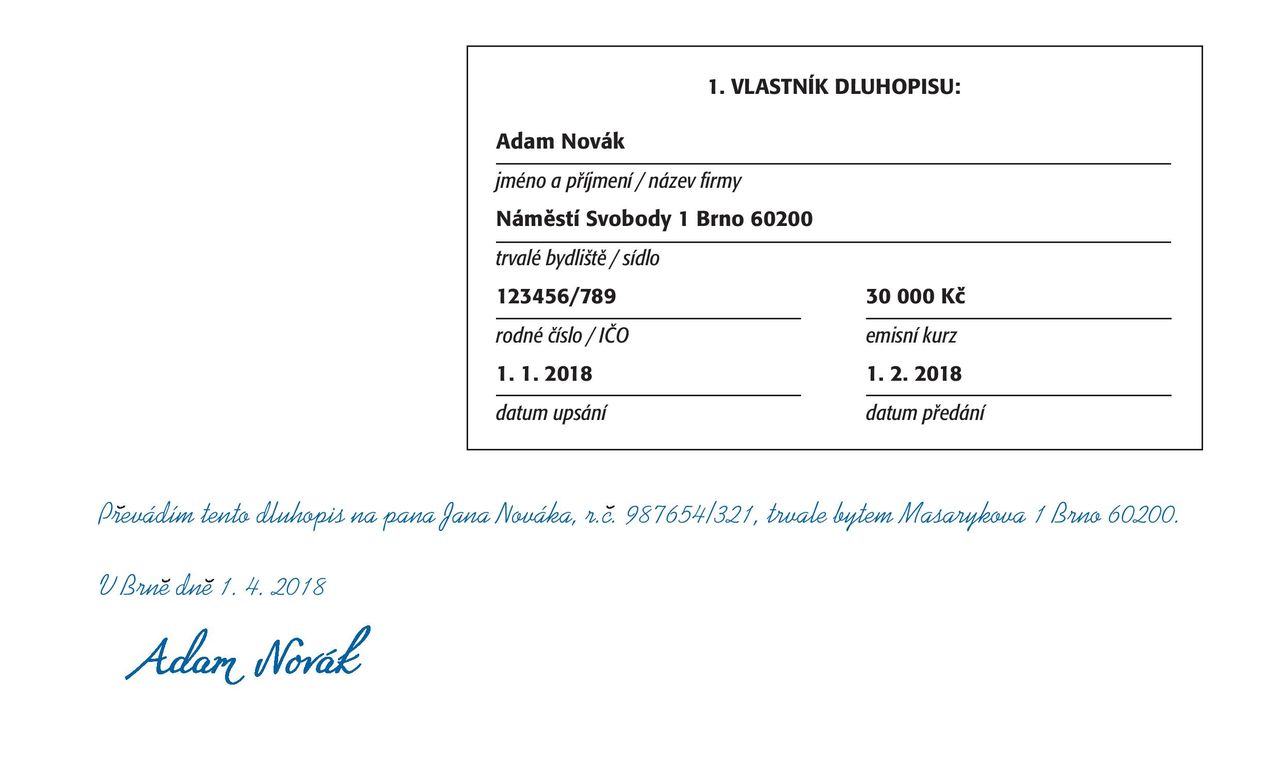

On the back of the bond, there is a table listing the details of the first owner. You need to enter the new owner's details below this table and sign it by hand. This must be done on each bond you wish to transfer. A sample of how to fill it in can be found here:

The new owner must then provide us with proof of the transfer and inform us of the bank account number where they wish to receive interest payments and the bond principal repayment.

When transferring bonds, please pay close attention to the record dates to ensure that you notify us of the transfer well in advance of the interest payment or maturity date.

You are not required to report the change, but it is always better if we have your current information. If you wish to inform us of the change, you can contact us HERE.

It is always a good idea to report any change in contact details so we can stay in touch with you. You can notify us of the change HERE.

The account number can only be changed in person upon presenting an ID, or by sending a written notice by post with a notarized signature. A sample notice of account number change can be downloaded HERE.

No, these are not government-issued bonds.

There are many differences, which is why every investor should carefully study the bond's terms and prospectus (download HERE).

Yes, you can. Please make sure to indicate this fact at the time of purchase and provide the relevant documents so we can properly register your tax status.

Bonds can only be issued to the person who signed the subscription agreement, or to someone representing them. However, it is possible for an investor who purchases the bonds to later transfer them to another person, including as a free gift.

A bond cannot be co-owned without specifying a person who will exercise the rights of the owner. However, if you wish to split the investment, it is possible for each spouse to sign a subscription agreement for half of the invested amount.

If your bonds are stolen, contact us immediately and provide appropriate proof, such as a police report. We will then block the bonds to prevent any changes to the registered bank account. All payments will continue to be made only to the account we have on record, so you will not lose your invested funds. The same procedure applies if the bonds are lost or destroyed.

Interest from the bonds is paid regardless of whether the owner is alive. If a payment is returned to us, for example due to a closed bank account, we will wait up to ten years for the owner or their heirs to contact us and request the interest and principal payout. If there are multiple heirs, the bonds will be divided among them according to the terms of the inheritance ruling.

If you find such bonds, inform the notary handling the inheritance proceedings and provide all relevant details, such as the serial numbers of the bonds. The notary will contact us, and we will provide them with all necessary information. It is possible that the bonds have already been repaid, but if they are still outstanding, we will repay the full principal and interest to the rightful heirs under the same conditions as we would have to the original owner.

You can request early redemption of one or more bonds, and the invested amount will be paid to you after a two-month period. The repaid amount of the principal and the proportional interest will be reduced by a percentage specified in the terms of the specific bond issue for early redemption. For example, with the e-Finance Property 23 bonds, this reduction is 7%. If you wish to request early redemption, please contact us HERE.

We treat all personal data as confidential and use it only when necessary. We value all our investors and do not bother them with unsolicited advertising. You can find more details HERE.