Rising Property Prices in the EU: What Does It Mean for Investors and Rental Housing in the Czech Republic?

Recent Eurostat figures show that residential property prices in the Czech Republic are on the rise once again. What are the implications, and how should you respond?

The European Statistical Office (Eurostat) recently published statistics on the development of residential property prices and rental costs across European Union countries. The data not only provide a macroeconomic perspective on the housing market but also have direct implications for local decision-making by investors, developers, and rental housing operators.

The real estate market in the European Union (EU), as well as in the Czech Republic, is undergoing dynamic changes influenced by various economic factors, including inflation, interest rates, and demographic shifts. What do these developments mean for property investors? Will property prices continue to rise, or are we heading for a decline?

Trends in Property Prices and Rents in the EU and Czech Republic

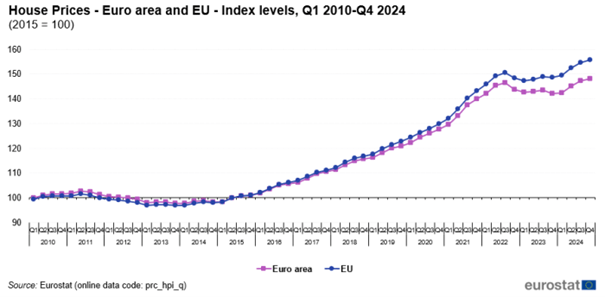

After 2013, the EU property market experienced a period of significant price growth (as shown in Figure 1), driven by low interest rates and rising demand. This trend was further amplified in 2021 and 2022, when households channelled their pandemic-era savings into real estate. In the Czech Republic, property prices have more than doubled since 2010. However, 2023 brought a turning point: high inflation and increasing interest rates led to a market slowdown, resulting in a drop in property prices. According to Eurostat, property prices in the EU decreased by 0.3% quarter-on-quarter in Q4 2023.

Figure 1 – Property Price Trends Over Time

Source: Eurostat, 2025 [cited 24/04/2025] Available at:

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Housing_price_statistics_-_house_price_index

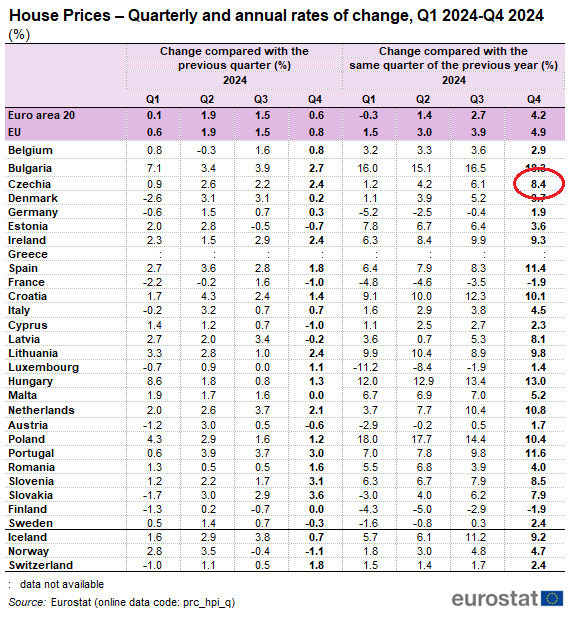

Figure 2 – Quarterly and Annual Property Price Growth

Source: Eurostat, 2025 [cited 05/05/2025] Available at:

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Housing_price_statistics_-_house_price_index

In the Czech context, it is important to highlight that between Q4 2023 and Q4 2024, residential property prices increased on average by 8.4%, placing the Czech Republic among the fastest-growing markets in the entire EU. Only a few countries recorded higher year-on-year growth, such as Bulgaria (18.3%), Hungary (13.0%), or Spain (11.4%).

In the last quarter of 2024, residential property prices in the European Union increased year-on-year by 4.9%, and by 4.2% in the eurozone. The published data confirm that the real estate market in Europe has entered a renewed growth phase following a brief period of stagnation.

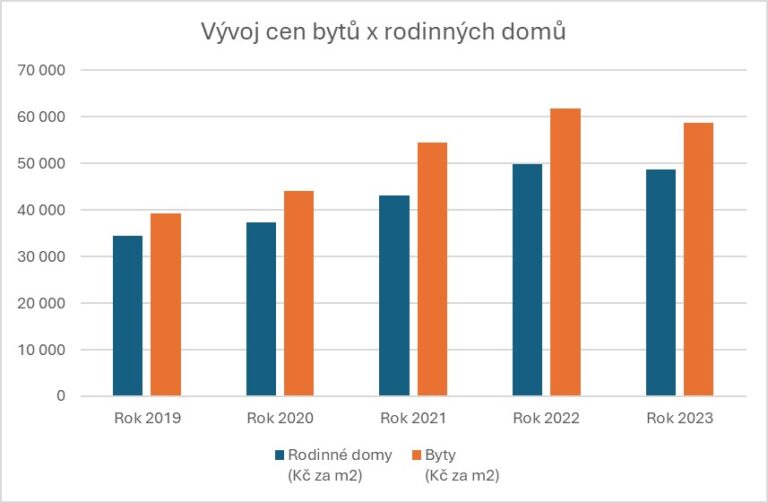

Figure 2 – Average Price per m2 of Family Houses and Apartments in the Czech Republic

Source: Own processing based on data from the Czech Statistical Office (CZSO) [cited 24/04/2025] Available at:

https://vdb.czso.cz/vdbvo2/faces/cs/index.jsf?page=vystup-objekt&z=T&f=TABULKA&skupId=5073&katalog=31782&&pvo=CEN14A&&u=v7__VUZEMI__97__19&str=v52#w=

The chart above (Figure 2) illustrates a significant increase in residential property prices in the Czech Republic over the past five years. Apartment prices grew the most, exceeding 60,000 CZK per m² on average in 2022, with only a slight decline in 2023. Prices of family houses increased at a similar pace but remained slightly below apartment prices.

This development confirms the attractiveness of the real estate market for investors – property has maintained high value despite economic fluctuations. However, for households, it means a higher financial burden when purchasing a home and higher rental costs.

The analysis of the presented data highlights the current dynamics of the rental housing market, and it is essential to factor in these aspects when making investment decisions.

Property Prices Are Rising Twice as Fast as Rents

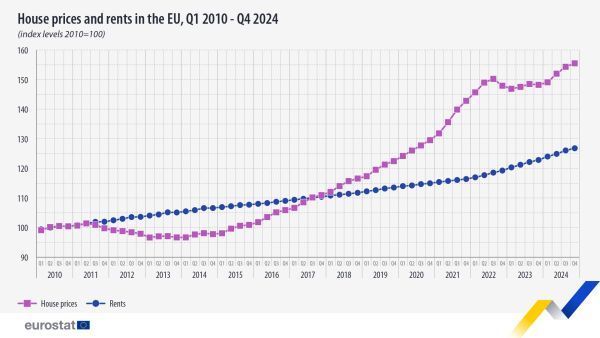

According to Eurostat (Figure 3), from 2010 to Q2 2024:

- Property prices in the EU increased by 51.8%

- Rents rose by only 24.8%

This difference is crucial and indicates that the return on property investment (known as gross rental yield) is decreasing in most countries if rents are not keeping pace with asset purchase prices.

For investors, this means that the rental income strategy is currently less attractive in countries with fast-growing prices, making cost management, location selection, and rental period even more critical for long-term profitability.

Figure 3 – Trends in Property Prices vs. Rental Prices Over Time (blue = rents; pink = property prices)

Source: Eurostat, 2025 [cited 24/04/2025] Available at:

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Housing_price_statistics_-_house_price_index

What Does This Mean for Investors and Developers?

The current trend of rising property prices in the European Union presents both challenges and opportunities for investors and developers. On one hand, increasing prices raise the value of existing properties, potentially resulting in higher capital gains for owners. On the other hand, growing acquisition costs and the rising price of construction materials may impact the profitability of new development projects. Our company carefully analyses market conditions and focuses on attractive projects in high-demand, lucrative locations.

In the coming period, property prices in the Czech Republic are expected to continue rising, even despite the anticipated decline in mortgage interest rates.

What Are the Implications?

The rapid rise in property prices significantly increases housing costs and makes home ownership less accessible. This affects young people and low-income households the most, as owning a home becomes increasingly out of reach. At the same time, rising property prices push rents higher, placing additional strain on household budgets and reducing financial stability.

However, this new situation also highlights an investment opportunity for those who want to benefit from rising property values without owning real estate directly. Individuals can invest their funds through secured bonds, strategically allocating them to high-quality and profitable real estate projects. If you're interested in investing in a proven growth real estate market, you can take advantage of our secured bonds starting from CZK 50,000. Learn more about secured bonds in the secured bonds section or click HERE.

The e‑Finance Group, which has been active on the market for over 20 years, offers investors access to properties in attractive locations – from city apartments to hotel and recreational properties – with an emphasis on stability, long-term value, and professional management.

Invest in real estate and service quality. Invest with e‑Finance.

Sources:

https://csu.gov.cz/ceny-nemovitosti?pocet=10&start=0&podskupiny=014&razeni=-datumVydani

https://statistikaamy.csu.gov.cz/rust-cen-nemovitosti-v-eu-se-loni-zastavil

Related articles

August EFI NEWS 2025: A Summer Full of Flavors, Fun, and Investment Opportunities

Investment Bulletin for Q2 2025