Anti-inflation bonds

Four-year anti-inflation bonds e–Finance

In response to the stabilization of the economic environment and reduction of inflation, e-Finance CZ offers issuances of anti-inflation and other types of bonds, designed to provide opportunities for investors seeking growth of their finances in the newly balanced economic climate. In the event of an economic turnaround and inflation beginning to rise again, anti-inflation bonds may become an attractive investment, offering an appealing opportunity for capital protection and appreciation.

Inflation development in the Czech Republic

Why e-Finance?

According to the audited financial statements for the period 2024

for income properties

external sources on the value of the portfolio

on the investment property market

from bonds for the public

After the implementation of planned investments

commercial and residential properties

Annual yield

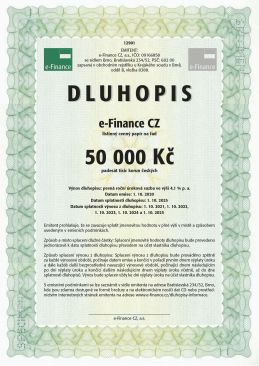

Four-year anti-inflation bonds e‑Finance CZ

Investment due on October 1,2029

- investment from CZK 50,000

- annual interest INFLATION + 1% is paid out every year

- the bond can be repaid early at the end of the interest period

- the bond issuer is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Bond pre-order

Request for information

Bonds e‑Finance CZ Anti-inflation 39 with annual interest INFLATION + 1 %

The company e‑Finance CZ issues, as of October 1, 2025, the inflation-linked bonds e‑Finance CZ Anti-inflation 39 within the e‑Finance CZ bond program, with a total maximum volume of CZK 3,000,000,000 and a maximum outstanding bond volume of CZK 500,000,000. The bonds e‑Finance CZ Anti-inflation 39 can be ordered from August 8, 2025.

Interest Yield

The bonds bear interest at a floating interest rate, calculated as the sum of a fixed interest rate of 1% and the percentage change in the underlying consumer price index. To protect investors against potential deflation, the issuer has specified in the base prospectus that the floating interest rate will never be negative. Interest will be paid to the bondholder on October 1, 2026, October 1, 2027, October 1, 2028, and October 1, 2029.

Form of Bonds

The bonds are issued in paper form, registered in the holder's name, and are freely transferable by endorsement. The transfer does not require approval and is not subject to any fees. Similarly, subscription to the bond is carried out without any fees.

Use of Proceeds from Bonds

The issuer intends to invest the proceeds obtained from the bonds primarily in the development and financing of business activities of the issuer, its parent company, and sister companies, particularly in the areas of construction, purchase, revitalization, leasing, operation, and sale of real estate; acquisition of business shares in commercial corporations whose main economic activity is the management of their own real estate; establishment of commercial corporations whose main economic activity is the management of their own real estate; management of business shares held by the issuer, parent company, or sister companies in commercial corporations; and the development and financing of commercial corporations in which the issuer, parent company, or sister companies hold a business share.

Bond Redemption

The bondholder may request redemption at the end of the current interest period, provided that such request is made no later than three months before its end. The notice period is 3 months.

Subscription and Purchase of Bonds

First, you will conclude a bond subscription and purchase agreement, then pay the issue price of the subscribed bonds either by transfer to the account specified in the agreement or in cash (cash only up to the equivalent of CZK 250,000), after which the bonds will be handed over to you. Bonds can also be sent by mail as an insured valuable shipment. The nominal value of one bond and the minimum investment amount is CZK 50,000. The bond subscription agreement can be concluded directly at the headquarters of e-Finance Group in Brno at Bratislavská 234/52, by correspondence, or after filling out the order form below.

Approval by the Czech National Bank

The base prospectus of the bonds has been approved by the Czech National Bank as the competent authority pursuant to Regulation (EU) 2017/1129.

Complete CNB decision on the approval of the base prospectus of the bond offering program

The Czech National Bank approves this prospectus only in terms of its compliance with the standards regarding completeness, comprehensibility, and consistency required by Regulation (EU) 2017/1129. This approval should not be understood as an endorsement of the quality of the securities that are the subject of this prospectus. Investors should conduct their own assessment of the suitability of investing in these securities. We recommend that potential investors read the prospectus before making an investment decision to fully understand the potential risks and returns associated with the decision to invest in the securities.

Complete Information

Download: e-Finance CZ – base prospectus of the bond program

Download: Final terms of the offer for the issue of e-Finance CZ Anti-inflation 39 Bonds

The issue conditions can also be reviewed at the issuer's headquarters at Bratislavská 234/52, Brno, where they are available free of charge in brochure form and on electronic data carrier CD.

Currently, e-Finance offers the following types of bonds:

One-year bonds with a yield of 7%

Investment due on March 1, 2027

- investment from CZK 50,000

- annual interest 7%

- one-year bonds

- bond can be repaid early at the end of the interest period

- bond issuer is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Two-year bonds secured by Račice Castle with yield up to 8 %

Investment due on October 1, 2027

- investment from CZK 50,000

- annual interest 8% for the first yield period (October 1, 2025 to September 30, 2026)

- annual interest 7% for the second yield period (October 1, 2026 to September 30, 2027)

- bonds are secured by Račice Castle properties

- bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Three-year bonds secured by Račice Castle with a high yield of up to 9 %

Investment due on November 1, 2028

- investment from CZK 50,000

- annual interest 9% for the first yield period (October 1, 2025 to October 31, 2026)

- annual interest 8% for the second yield period (November 1, 2026 to October 31, 2027)

- annual interest 7% for the third yield period (November 1, 2027 to October 31, 2028)

- bonds are secured by Račice Castle real estate

- bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Three-year bonds secured by EFI Hotel & Properties shares with a high yield of up to 9 %

Investment due on November 1, 2028

- investment from CZK 50,000

- annual interest 9% for the first yield period (October 1, 2025 to October 31, 2026)

- annual interest 8% for the second yield period (November 1, 2026 to October 31, 2027)

- annual interest 7% for the third yield period (November 1, 2027 to October 31, 2028)

- bonds are secured by shares of the hotel and real estate group EFI Hotels & Properties, a.s.

- the bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Bond pre-order

Request for information

Questions and Answers

Our strategy is to invest in real estate in the Czech Republic, either to increase its value through renovation and subsequent sale, or for the purpose of holding and renting the properties. We are also involved in the development of apartment buildings and family houses. Specific projects we are working on, including photo documentation, can be found HERE.

No, these are not government-issued bonds.

Bonds can only be issued to the person who signed the subscription agreement, or to someone representing them. However, it is possible for an investor who purchases the bonds to later transfer them to another person, including as a free gift.