Secured by shares in EFI Hotels & Properties, a.s.

The e-Finance, a.s. Group is a real estate investment group that has been investing in properties in attractive locations in the Czech Republic for more than 20 years, including commercial and administrative buildings, hotels, and residential properties.

The portfolio of completed and leased properties of the e-Finance, a.s. group already exceeds CZK 1,98 billion, and the future value of real estate projects in preparation and under construction exceeds CZK 2,64 billion. Our current investment portfolio of real estate owned by e-Finance can be viewed here.

Why e-Finance?

According to the audited financial statements for the period 2024

for income properties

external sources on the value of the portfolio

on the investment property market

from bonds for the public

After the implementation of planned investments

commercial and residential properties

Annual yield

e-Finance CZ Secured EFI 37 bonds with an annual interest rate of up to 9%

Investment due on October 1, 2028

- Investment from CZK 50,000

- Annual interest rate of 9% for the first yield period (September 1, 2025 to September 30, 2026)

- roční úrok 8 % za druhé výnosové období (1.10.2026 až 30.9.2027)

- Annual interest rate of 8% for the second yield period (October 1, 2026 to September 30, 2027)

- Annual interest rate of 7% for the third yield period (October 1, 2027 to September 30, 2028)

- The bonds are secured by shares in the hotel and real estate group EFI Hotels & Properties, a.s.

- The bond may be redeemed early at any time.

- The bond issuer is the commercial corporation e-Finance CZ, a.s.

- For more information, call 515 555 555 or email info@e-finance.eu

How much do you want to invest?

e-Finance CZ Secured EFI 37 bonds with annual interest rates of up to 9%, 8% and 7%

On September 1, 2025, e-Finance CZ will issue e-Finance CZ Secured EFI 37 bonds as part of the e-Finance CZ bond program. e-Finance CZ Secured EFI 37 bonds can be ordered from July 7, 2025.

Interest yield

The bonds carry a fixed yield of 9% p.a. for the first yield period (September 1, 2025 to September 30, 2026), 8% p.a. for the second yield period (October 1, 2026 to September 30, 2027) and 7% p.a. for the third yield period (October 1, 2027 to September 30, 2028). The interest rate is fixed for the entire period and does not change regardless of any decline in bank interest rates. Interest will be paid to the bondholder on October 1, 2026, October 1, 2027, and October 1, 2028.

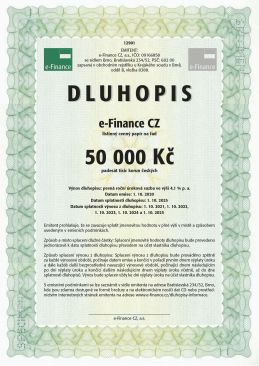

Form of bonds

The bonds are issued in paper form, registered, and freely transferable by endorsement, with the transfer not subject to approval or fees. The subscription of the bond is also carried out without any fees.

Subscription and purchase of bonds

First, conclude a contract for the subscription and purchase of bonds, then pay the issue price of the subscribed bonds, either by transfer to the account specified in the contract or in cash (cash only up to the equivalent of CZK 250,000), and the bonds will then be handed over to you. The bonds can also be sent by post as an insured valuable shipment. The nominal value of one bond and the minimum investment amount is CZK 50,000. The bond subscription agreement can be concluded directly at the registered office of e-Finance CZ, a.s. in Brno at Bratislavská 234/52, or at the Prague branch in the City Empiria building, Na Strži 1702/65, Prague, or by correspondence or by completing the order form below.

Investment opportunity secured by a lien

The investment and real estate group e-Finance, a.s. is introducing three-year bonds secured by a lien on the shares of the hotel group EFI Hotels & Properties, a.s. to the Czech investment market.

The issue of e-Finance Bonds secured by a lien on the shares of the EFI Hotels & Properties, a.s. group offers investors the opportunity to invest their funds with a three-year horizon at 9% annual interest in the first year, 8% annual interest in the second year, and 7% annual interest in the third year. Interest is paid once a year. This yield is fixed and is not tied to the declining base rate of the Czech National Bank, which is commonly used as a benchmark for savings account rates on the market. The offer is valid until the entire planned volume of bonds in the amount of CZK 400 million has been subscribed. According to the bond prospectus, which was approved by the Czech National Bank on March 4, 2024, the total value of issued and outstanding bonds will not exceed CZK 800 million.

Audit of consolidated financial statements

The EFI Hotels & Properties, a.s. group has its consolidated financial statements audited by the renowned international company BDO Audit s.r.o. with an "unqualified" auditor's opinion. The audited consolidated financial statements are available for download below.

Investment assets of the EFI Hotels & Properties

According to the audited consolidated financial statements for 2023, which can be downloaded below, EFI Hotels & Properties, a.s. has assets worth CZK 1.36 billion.

The largest part of these assets consists of real estate worth CZK 1.15 billion. According to the audited financial statements, the equity of EFI Hotels & Properties, a.s. amounts to CZK 821 million. The assets of the EFI Hotels & Properties, a.s. group consist of 100% shares in hotel and real estate corporations. The value of these shares was determined in 2023 by expert opinions prepared by the renowned expert institute ZNALCI A ODHADCI – znalecký ústav, spol. s r.o. The opinions can be found below for download.

The subsidiaries of EFI Hotels & Properties, a.s. operate and manage hotels and rental properties, offices, commercial premises, and apartments under the well-known EFI brand.

All properties belonging to the EFI Hotels & Properties, a.s. group are in perfect condition, are functional and approved for use, and are operated with a positive EBITDA indicator.

Use of investment funds

The investment and real estate corporation e-Finance, a.s. has been operating on the market for 24 years. It uses the funds obtained from bond issues for investments exclusively related to commercial properties such as hotels, apartment buildings, office and retail spaces, which it operates under the well-known and renowned EFI brand.

If you start investing with e-Finance, a.s., you will share in the profits from commercial real estate. Investing with us will always bring you attractive interest rates with adequate collateral in the form of real assets. In the future, we will give our investors priority access to an offer to subscribe for shares in the EFI Hotels & Properties, a.s. group. If you take advantage of this offer, you will become a direct owner of EFI Hotels & Properties, a.s. with a regular annual dividend. The investment and real estate corporation e-Finance, a.s.

Repurchase of bonds

The e-Finance Group also guarantees the repurchase of bonds if you need the invested funds or part thereof earlier. This repurchase is subject to a fee in accordance with the terms and conditions of the approved bond prospectus and specific issue conditions.

Investor benefits

Every investor investing in e-Finance, a.s. secured bond issues will receive a voucher for a 20% discount on a stay of up to five days for six people at any EFI Hotel, see www.efihotels.com Every quarter, we send our investors our Investment Bulletin, where we regularly inform them about our results and present them with further investment opportunities. The latest issue of our Investment Bulletin can be found HERE.

Documents for download

Approval by the Czech National Bank

The base prospectus for the bonds has been approved by the Czech National Bank as the competent authority pursuant to Regulation (EU) 2017/1129.

Complete decision of the CNB on the approval of the base prospectus for the bond offering program

The Czech National Bank approves this prospectus solely in terms of its compliance with the standards of completeness, comprehensibility, and consistency imposed by Regulation (EU) 2017/1129. This approval should not be construed as an endorsement of the quality of the securities that are the subject of this prospectus. Investors should make their own assessment of the suitability of investing in these securities. We recommend that potential investors read the prospectus before making an investment decision in order to fully understand the potential risks and returns associated with the decision to invest in the securities.

Complete information

Download: e-Finance CZ 2025 Prospectus

The data presented in the consolidated balance sheet of EFI Hotels & Properties, a.s. on pages 30 and 48, marked as the previous accounting period, are data for the period ending June 27, 2023.

Download: Final terms and conditions of the e-Finance CZ Secured EFI 37 bond issue

The terms and conditions of the issue are also available at the issuer's registered office at Bratislavská 234/52, Brno, where they can be obtained free of charge in the form of a brochure and on CD.

Bond pre-order

Request for information

Currently, e-Finance offers the following types of bonds:

One-year bonds with a yield of 7%

Investment due on March 1, 2027

- investment from CZK 50,000

- annual interest 7%

- one-year bonds

- bond can be repaid early at the end of the interest period

- bond issuer is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Two-year bonds secured by Račice Castle with yield up to 8 %

Investment due on October 1, 2027

- investment from CZK 50,000

- annual interest 8% for the first yield period (October 1, 2025 to September 30, 2026)

- annual interest 7% for the second yield period (October 1, 2026 to September 30, 2027)

- bonds are secured by Račice Castle properties

- bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Three-year bonds secured by Račice Castle with a high yield of up to 9 %

Investment due on November 1, 2028

- investment from CZK 50,000

- annual interest 9% for the first yield period (October 1, 2025 to October 31, 2026)

- annual interest 8% for the second yield period (November 1, 2026 to October 31, 2027)

- annual interest 7% for the third yield period (November 1, 2027 to October 31, 2028)

- bonds are secured by Račice Castle real estate

- bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Three-year bonds secured by EFI Hotel & Properties shares with a high yield of up to 9 %

Investment due on November 1, 2028

- investment from CZK 50,000

- annual interest 9% for the first yield period (October 1, 2025 to October 31, 2026)

- annual interest 8% for the second yield period (November 1, 2026 to October 31, 2027)

- annual interest 7% for the third yield period (November 1, 2027 to October 31, 2028)

- bonds are secured by shares of the hotel and real estate group EFI Hotels & Properties, a.s.

- the bond can be repaid early at any time

- the issuer of the bond is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Four-year anti-inflation bonds e‑Finance CZ

Investment due on October 1,2029

- investment from CZK 50,000

- annual interest INFLATION + 1% is paid out every year

- the bond can be repaid early at the end of the interest period

- the bond issuer is the business corporation e-Finance Group

- information by phone 515 555 555 or by email info@e-finance.eu

Questions and answers

Our strategy is to invest in real estate in the Czech Republic, either to increase its value through renovation and subsequent sale, or for the purpose of holding and renting the properties. We are also involved in the development of apartment buildings and family houses. Specific projects we are working on, including photo documentation, can be found HERE.

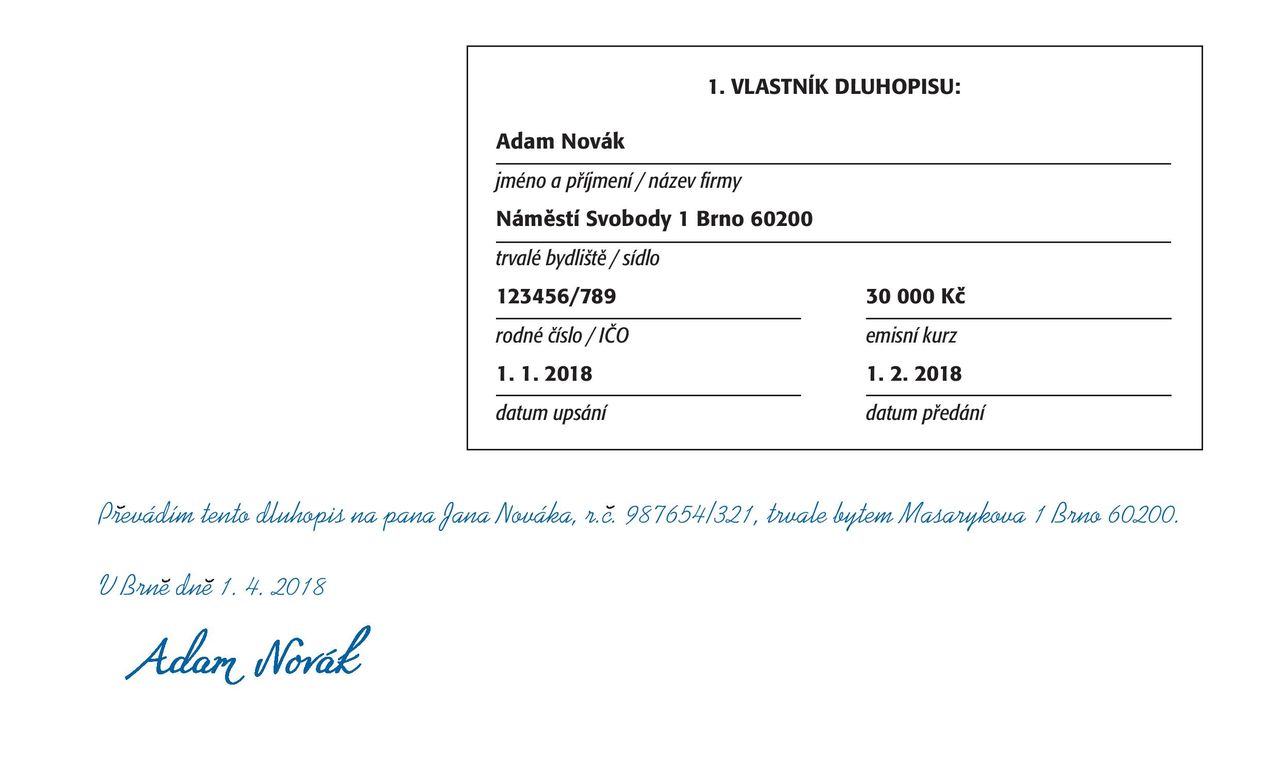

On the back of the bond, there is a table listing the details of the first owner. You need to enter the new owner's details below this table and sign it by hand. This must be done on each bond you wish to transfer. A sample of how to fill it in can be found here:

The new owner must then provide us with proof of the transfer and inform us of the bank account number where they wish to receive interest payments and the bond principal repayment.

When transferring bonds, please pay close attention to the record dates to ensure that you notify us of the transfer well in advance of the interest payment or maturity date.

If you find such bonds, inform the notary handling the inheritance proceedings and provide all relevant details, such as the serial numbers of the bonds. The notary will contact us, and we will provide them with all necessary information. It is possible that the bonds have already been repaid, but if they are still outstanding, we will repay the full principal and interest to the rightful heirs under the same conditions as we would have to the original owner.